Understanding the Basics of Debt

Hello, Code Red Financial readers, in today’s discussion, we explore the subject of debt.

The concepts of saving and managing debt have fascinated me for as long as I can recall, dating back to when I was about seven years old. Perhaps it’s due to my less-than-middle-class upbringing, but for whatever reason, I’ve always had an aversion to debt. To be honest, I haven’t always adhered to my ideal of avoiding it or preparing adequately, especially in my younger days. For example, the fear of debt might compel someone to buy a cheap, unreliable car to dodge a car loan, only to end up with a vehicle that demands more money for repairs, not to mention the time and stress involved. In hindsight, that’s not such a wise investment, is it?

Debt is a financial obligation that arises when individuals borrow money or buy goods and services with the promise to repay the amount borrowed plus any applicable interest. For teens and young adults, understanding the various forms of debt is essential, as it can significantly impact their financial health both now and in the future. The most common forms of debt are student loans, credit card debt, auto loans, and personal loans.

Student loans are often one of the first types of debt that young adults encounter, as they seek higher education to enhance their career prospects. These loans can provide the necessary funds to cover tuition and related expenses, but they typically carry high interest rates that can accumulate over time, leading to substantial repayment obligations. Teens must be aware of the long-term effects of student loan debt, including the potential to hinder their ability to save and invest for future wealth building.

Credit card debt is another prevalent form of debt among young adults. Many are tempted by the convenience of credit cards, but they often fail to realize how quickly balances can escalate due to high interest rates and late fees. Mismanagement of credit card debt can lead to poor credit scores, which will affect future borrowing capabilities and could impact essential aspects of their lives, such as securing a mortgage or obtaining a car loan.

There are numerous misconceptions regarding debt, including the belief that all debt is inherently bad. However, not all forms of debt are detrimental; when used wisely, certain types may help build wealth. For instance, taking on debt to invest in education or a profit venture can yield positive returns. Therefore, it is crucial for teens and young adults to understand the true nature of debt, as well as effective strategies for managing it, to foster sound financial decisions that support their wealth-building goals.

The True Cost of Debt During Your Formative Years

During the formative years of a teenager and young adult, financial decisions can have far-reaching effects. Debt, often perceived as a quick solution to immediate financial needs, carries a profound cost that can shape an individual’s financial future. Early engagement with debt—whether through credit cards, loans, or financing options—can lead to significant long-term consequences. A study from the National Endowment for Financial Education indicates that a large percentage of young adults carry credit card debt, leading to financial struggles that often extend into later life.

One of the most immediate consequences of accumulating debt at a young age is the impact on credit scores. Credit scores play a crucial role in determining future financial opportunities, such as qualifying for loans or credit cards, securing low-interest rates, and even impacting rental agreements. A poor credit score, often stemming from early debt mismanagement, can result in higher interest rates and difficulty in acquiring necessary loans, ultimately restricting one’s financial mobility.

The long-term effects on net worth cannot be overstated. According to a report from the Federal Reserve, young adults with high levels of debt tend to accumulate wealth at a slower pace compared to their debt-free counterparts. As they grapple with monthly repayments, opportunities to save, invest, and ultimately build wealth diminish. Compounding interest on unpaid debt can further exacerbate this issue, leading to a cycle of debt that may take years to escape.

Consider the case of a young adult who takes on significant student loans without a clear repayment plan. This individual may find themselves delaying major life milestones such as buying a home or make investments for retirement, all due to the financial strain of their debt. Statistics show that individuals with student loans often postpone such milestones, which can delay their path to wealth building.

In essence, while debt can seem like a necessary tool in the modern financial landscape, it is vital for young individuals to recognize the long-term pitfalls of borrowing too much too soon.

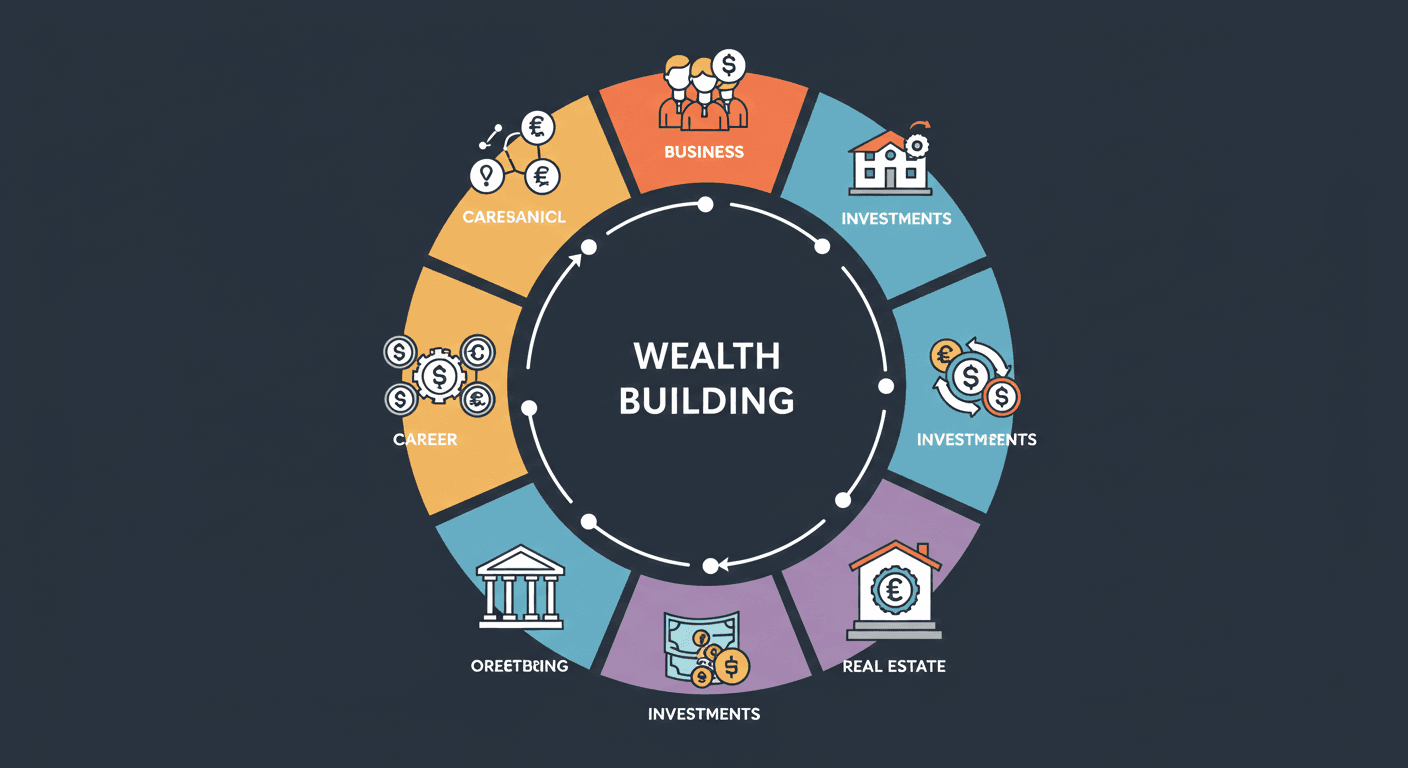

Wealth-Building Strategies for Young Adults

Embarking on the journey to wealth-building during teenage and early adult years can set a strong foundation for future financial stability. One of the most essential strategies for young adults is budgeting. Crafting a budget helps individuals track their income and expenditures, ensuring they are aware of their financial status. By allocating funds for necessities, discretionary spending, and savings, young individuals can develop disciplined financial habits that foster long-term wealth accumulation.

Following a budget, saving money consistently is equally crucial. Young adults should aim to set aside a portion of their income, even if it’s a modest amount. Establishing an emergency fund can provide financial security and prevent debt accumulation in unforeseen circumstances. Additionally, automating savings through direct deposit options can simplify the process and promote regular contributions without added effort.

Early investment strategy is another pivotal strategy in the wealth-building equation. Young adults can take advantage of compound interest by starting to invest as soon as possible, even with small amounts. Options such as stocks, bonds, and mutual funds can yield significant returns over time, especially when investments are made consistently from a young age. Understanding risk tolerance is essential, as a well-balanced portfolio can help mitigate risks while maximizing potential gains.

Moreover, embracing financial literacy is vital for effective wealth management. Young adults should educate themselves about essential financial concepts, such as credit scores, interest rates, and market trends. Numerous resources like books, online courses, and financial blogs can equip them with the knowledge necessary to make informed decisions. As the financial landscape continually evolves, continuous learning will empower young individuals to adapt and thrive in their wealth-building efforts.

By focusing on these wealth-building strategies—budgeting, saving and enhancing financial literacy—young adults can embark on a journey toward lasting financial security and abundance.

The Importance of Financial Education

Financial literacy is a vital skill that’s often missing in school programs. A lot of students don’t learn the basics of handling money, recognizing debt, or growing their savings. This lack of knowledge can really set back young folks when they’re trying to figure out their finances. Without a good grasp on money matters, young people might struggle with debt, make shaky investment choices, or not put away enough for a rainy day or their big dreams.

This lack of preparation can have long-term consequences that follow individuals into adulthood. Young people may enter the workforce without knowledge of budget management, credit scores, and debt repayment strategies. The absence of this critical education creates a cycle of financial misunderstanding that can contribute to broader socioeconomic issues. Educating oneself about finances is essential not only for personal stability but also for fostering a financially literate society.

Luckily, there’s a wealth of resources out there for self-learners. Online platforms such as EDX.com and Coursera.com offer a variety of financial courses aimed at younger folks, tackling everything from the fundamentals of budgeting to complex investment tactics. Plus, there are websites and apps dedicated to financial education that can help sharpen your money management skills. And let’s not forget about the books written for young adults that delve into personal finance, offering guidance and practical steps to handle debt and grow your wealth.

In addition to self-study, financial workshops aimed at the youth can serve as valuable tools. These workshops often facilitate discussions about real-life financial scenarios, helping participants understand the consequences of their financial choices. By engaging in these educational avenues, young individuals can equip themselves with the knowledge and skills necessary to not only manage debt but also lay a solid foundation for building wealth over time.

Building Credit from a Young Age

Establishing a robust credit history during your teenage and young adult years is a crucial step toward achieving financial stability and success in adulthood. A strong credit profile not only facilitates access to credit but also leads to better interest rates on loans and credit cards, which can save you considerable amounts over time. To start building credit responsibly, it is advisable to understand the various types of credit accounts available.

One of the most common ways to begin is by getting a secured credit card. This card requires a deposit that acts as your credit limit, minimizing the risk for lenders while allowing you to establish a credit history. After using the secured card for a few months, and demonstrating responsible behavior, you may qualify for an unsecured credit card. Another option is to become an authorized user on a parent or guardian’s credit card. This strategy can help you inherit their positive credit behaviors as long as they maintain good payment habits.

To maintain a healthy credit score, it’s essential to pay your bills on time. Late payments negatively impact your credit score and can remain on your report for lengthy periods. Additionally, keeping your credit utilization ratio low—typically, below 30%—is advantageous. This figure is determined by comparing the total amount of credit you’re using to your total available credit. In addition, monitoring your credit regularly allows you to catch any discrepancies or unauthorized activities early.

Furthermore, it is advisable to avoid opening too many accounts within a short timeframe, as this can signal to lenders that you are a risky borrower. By being mindful and taking calculated steps toward building credit during your formative years, you can lay a solid foundation for your financial future. Good credit opens doors to numerous opportunities, allowing you to implement effective wealth-building strategies down the line.

Common Pitfalls to Avoid

As teens and young adults embark on their financial journeys, they often encounter various pitfalls that can hinder their debt and wealth-building efforts. One prevalent mistake is the allure of lifestyle inflation, which occurs when individuals increase their spending as their income grows. This tendency can lead to a cycle of overspending, making it challenging to save effectively or invest for the future. Instead of succumbing to the pressure of maintaining a certain lifestyle, it is crucial to develop a budget that prioritizes saving and investment over instant gratification.

Another common issue is the reliance on credit cards, which can create a false sense of financial security. While credit cards can be useful for building credit history and handling emergencies, mismanagement can lead to significant debt accumulation due to high-interest rates. Young individuals should aim to use credit judiciously, ensuring that they pay off their balances in full and on time to avoid interest charges. It is essential to consider credit cards as a tool for responsible spending rather than an extension of income.

Furthermore, many teens and young adults fall short in establishing a savings habit. This oversight can result in missed opportunities to create an emergency fund or save for future goals. To counter this tendency, individuals should prioritize setting aside at least a small percentage of their income regularly. Modeling savings as a non-negotiable expense can help reinforce the importance of financial preparation. By understanding these common pitfalls and employing strategies such as disciplined budgeting, responsible credit usage, and consistent savings, young adults can significantly enhance their financial health and set the foundation for lasting wealth building.

Creating a Lifelong Financial Plan

Developing a sustainable financial plan is essential for teens and young adults looking to effectively manage debt while simultaneously building wealth. The foundation of this plan begins with setting clear and achievable financial goals. Whether the objective is to save for higher education, purchase a vehicle, or build an emergency fund, defining these goals provides direction and motivates individuals to adhere to their financial commitments.

Once goals are established, it is crucial to assess one’s financial health regularly. This involves tracking income, expenditures, and debts to gain a comprehensive understanding of one’s financial status. Create a budget that allocates funds for various categories—necessities, savings, debt repayment, and discretionary spending. Utilizing financial management tools or apps can facilitate this process, making tracking more efficient and helping to identify areas for improvement.

As life circumstances change, whether due to job changes, relationship status, or unexpected expenses, adapting the financial plan is vital. Reassessing goals on a semi-annual basis allows for adjustments—be it increasing savings contributions or reducing discretionary spending—for optimal debt management and wealth accumulation. Furthermore, as income grows, incorporating investment strategies, such as retirement accounts or other assets, becomes increasingly important. This strategic approach allows teens and young adults to cultivate a rich financial future.

Moreover, engaging in ongoing financial education can empower individuals to make informed decisions. Seeking resources such as books, workshops, or online courses on personal finance can enhance understanding and provide relevant insights into effective debt management and wealth building strategies. By adopting a proactive approach to their finances, young adults can work towards achieving financial independence, ensuring a secure and prosperous future.