Understanding Rent-to-Own Agreements

Transitioning from renting to owning a home often feels like stepping into a new life—a move filled with both promise and challenges. Rent-to-own agreements have emerged as a creative solution for those who may not yet qualify for a traditional mortgage but still dream of homeownership. This article explores every facet of rent-to-own deals, from understanding their structure and benefits, to choosing the right property, tackling financial and legal issues, and planning your smooth transition into homeownership.

Understanding Rent-to-Own Agreements

A rent-to-own agreement is a hybrid real estate contract that merges the flexibility of renting with the future possibility of owning your home. These arrangements are typically divided into two essential components:

The Rental Period

During the rental phase—commonly ranging from one to three years—you live in the property and pay a monthly rent. Unlike traditional leases, however, rent-to-own agreements often include an agreed-upon enhancement to your regular rental payment. In many cases, a portion of this rent is credited toward the eventual purchase price, allowing you to build equity over time. This feature is particularly attractive for those who do not yet have enough saved for a down payment or who face challenges meeting standard financing qualifications.

The Purchase Option

At the outset of the agreement, both the buyer (tenant) and the seller establish a predetermined purchase price. This fixed price is locked in regardless of market fluctuations, offering the advantage of price certainty in a volatile real estate market. At the end of the rental period, you have the right—but not the obligation—to purchase the home at this pre-agreed price. This aspect of the deal grants considerable control over your future and allows for long-term financial planning.

Why Rent-to-Own Works

Rent-to-own arrangements are crafted to empower renters, granting them the opportunity to transition toward full ownership in a structured way. The enhanced monthly payments equip you with a unique form of forced savings while simultaneously providing an option to secure a property at a favorable price before market conditions change dramatically. However, like any financial commitment, it’s crucial to understand the intricacies involved and to assess whether such an arrangement is right for your personal circumstances.

The Multiple Benefits for Renters

A rent-to-own plan is more than just a gateway—it’s an investment in your future that rewards you financially, professionally, and even personally. Here are several core benefits:

Building Equity While Renting

In conventional rentals, your monthly payments simply contribute to the landlord’s income. In contrast, rent-to-own deals allocate part of your payment toward building equity in the property. This means you are gradually investing in your future home, making every payment work double duty toward what will eventually be your largest financial asset.

Protection Against Market Fluctuations

Locking in a purchase price at the start of your rental period can be a significant financial advantage, especially in a rising market. If home prices surge, you still have the privilege of buying your property at the lower, predetermined rate. This security can help alleviate anxiety associated with unpredictable market cycles and offers prospects of considerable long-term savings.

Improving Creditworthiness

A rent-to-own agreement can serve as a financial training ground. For renters who may lack robust credit histories or who need time to repair their credit scores, making consistent, timely payments is instrumental in establishing a stronger credit profile. This improvement will help you secure more favorable terms when you eventually transition to a conventional mortgage.

Supporting Financial Discipline

The structure of a rent-to-own deal inherently encourages disciplined financial planning. Knowing that every rent payment could contribute to your future home purchase—while also helping you negotiate your intentions with an eventual exit strategy—motivates you to manage your budget carefully. Over time, this disciplined approach can make the shift to full ownership smoother and more efficient.

Choosing the Right Rent-to-Own Property

Success in a rent-to-own arrangement hinges on more than just the financial mechanics—it also depends on selecting a property that aligns with your long-term goals. Here are key considerations for making the right choice:

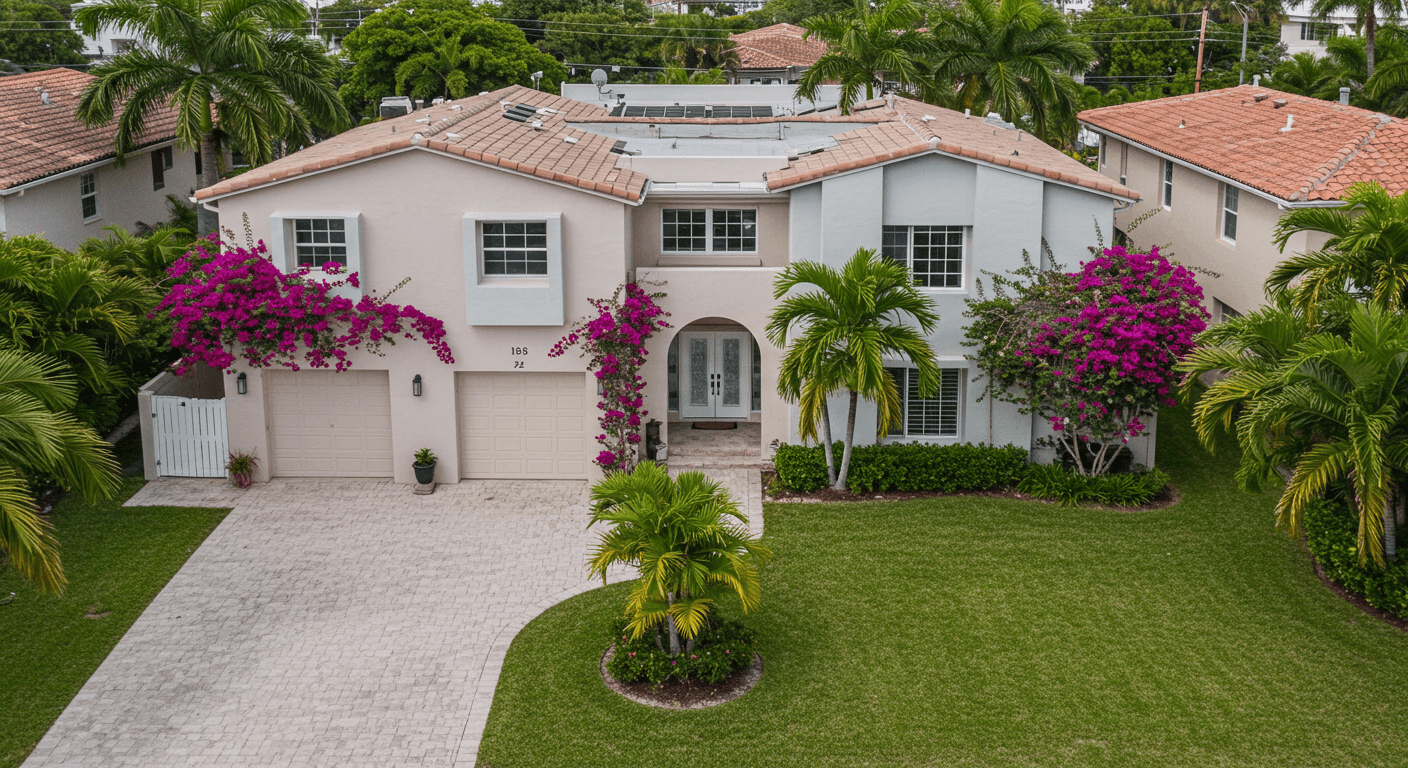

Location: It’s All About the Neighborhood

The importance of location cannot be overstated. A vibrant, accessible neighborhood offers more than just enjoyment—it influences the future resale value of your property. Investigate local amenities such as parks, shopping centers, and healthcare facilities, while also paying close attention to school districts and transportation options. A well-chosen location ensures that your investment retains its allure, both as a living space and a financial asset.

Assessing the Property Condition

Before committing to a rent-to-own agreement, arrange for a comprehensive property inspection. This evaluation should cover structural integrity, condition of the roof, plumbing, electrical systems, and overall maintenance history. Understanding the current state of the property allows you to budget for any immediate repairs and avoid future unexpected costs that might otherwise undermine your investment.

Understanding the Neighborhood Dynamics

Imagine living in the community not just now, but in the long term. Walk the streets at different times of day to gauge the environment. Consider safety statistics, community engagement, and the overall vibe of the area. Conversations with current residents can provide an unfiltered look at the lifestyle, ensuring that the neighborhood aligns well with your expectations.

Researching the Seller’s Background

A reputable seller is one of your strongest allies in a rent-to-own deal. Investigate the seller’s history and review any feedback from previous tenants. Transparent and fair practices on the part of the seller not only minimize the risk of disputes but also help streamline the eventual transition to homeownership.

Financial Considerations in Rent-to-Own Agreements

A critical component of the rent-to-own process is establishing a clear and sustainable financial strategy. Here are the fundamental elements to consider:

The Option Fee and Its Role

At the start of a rent-to-own contract, you will likely need to pay an option fee—a non-refundable deposit that secures your right to purchase the property in the future. Typically calculated as a percentage of the home’s purchase price, this fee showcases your commitment and is often credited toward the down payment should you decide to proceed with the purchase.

Monthly Rent Payments: More than Just Rent

In these agreements, monthly rent serves a dual purpose. Aside from covering the cost of living, a set portion may be credited toward the future purchase price of the home. It is crucial to fully understand and negotiate these terms upfront. Ask questions like:

- What percentage of each monthly payment contributes to the equity portion?

- Is this percentage fixed during the entire rental term?

- How might variations in market conditions affect this agreement?

Preparing for Other Ownership Costs

Becoming a homeowner does come with the additional financial responsibility of maintenance, property taxes, insurance, and sometimes homeowner association (HOA) fees. Start by developing a comprehensive savings plan that considers these ongoing costs. Even while you are renting, setting aside funds for future repairs and renovations can ease the adjustment once you own the property.

Budgeting and Financial Discipline

During your rental period, strict budgeting is pivotal. Create a detailed budget that includes your new monthly rent payment alongside your regular expenses. Determine areas where you can economize to maximize your savings for the future home purchase. Regularly update your budget and financial projections as you progress through the rental period, ensuring that you meet your savings goals before the lease expires.

Exploring Diverse Financing Options

While a rent-to-own path helps many navigate traditional financing hurdles, it never hurts to be informed about all available options. Research conventional mortgages as well as government-backed programs that might fit your financial status. Engaging with a financial advisor can offer personalized advice tailored to your situation, ensuring that you’re not left unprepared when the time to secure traditional financing arrives.

Legal Protections and Your Rights

A clear, well-written contract is the cornerstone of any successful rent-to-own arrangement. It ensures that both the renter and the seller understand their rights and responsibilities. Let’s break down the legal aspects you should consider:

The Importance of a Detailed Contract

Every term of the rent-to-own agreement should be documented in writing. Critical details include:

- The agreed-upon purchase price.

- The duration of the rental period.

- The option fee amount.

- The proportion of rent credited to the purchase price.

- Specifics regarding maintenance responsibilities and repair obligations.

This detailed contract not only offers legal protection but also sets clear expectations for both parties. Always read the fine print and clarify any ambiguous terms with the seller before signing on the dotted line.

Defining Default Scenarios and Remedies

What happens if circumstances change? In a robust contract, both parties should know what constitutes a default. For tenants, it’s important to understand that meeting all contractual obligations typically preserves your option to purchase. Conversely, the contract should clearly outline how default may lead to an eviction or termination of your option to buy. This clarity prevents future disputes and provides a roadmap for conflict resolution.

Accessing Legal Resources

When in doubt, legal expertise is invaluable. Consider consulting with an attorney who specializes in real estate or tenant law. A lawyer can dissect the contract, ensuring that your rights are safeguarded and that the contractual terms are fair and equitable. Additionally, local housing authorities and tenant rights organizations can serve as supportive resources should any disputes arise during the rental period.

Managing Your Transition from Renting to Owning

The journey from renting to becoming a homeowner is filled with both emotional and logistical changes. Managing this transition effectively can help you overcome challenges and smoothly navigate the shift. Here are key strategies:

Preparing for Maintenance Responsibilities

One of the most profound differences between renting and owning is the responsibility for maintenance. As a homeowner, repairs that were once the landlord’s duty suddenly become your duty. Start preparing by:

- Familiarizing Yourself with Routine Tasks: Learn basic skills for plumbing, electrical, and general home repairs.

- Creating a Maintenance Checklist: Develop a prioritized list of tasks for both the interior and the exterior of your future home.

- Budgeting for Repairs: Set aside a specific monthly amount in a “home maintenance fund” so that unexpected repairs don’t disrupt your overall finances.

By planning ahead, you’ll be better prepared to handle the realities of homeownership when your rental period comes to an end.

Developing a Comprehensive Financial Blueprint

An essential part of this transition is refining your financial plan. This plan should cover:

- Saving for the Down Payment: Even though part of your rent payment might contribute toward this cost, an additional savings goal is critical.

- Setting Aside Funds for Closing Costs: These can include attorney fees, inspections, and other administrative expenses.

- Planning for Ongoing Costs: Beyond repairs, think of property taxes, homeowner’s insurance, and potential upgrade costs.

Mapping out these details not only prepares you for the financial demands of homeownership but also helps reduce the anxiety of stepping into a new financial landscape.

Establishing Open Communication Channels

If you are in a rent-to-own agreement, consistent and transparent communication with your landlord is essential. Regularly review the terms of the agreement, discuss any concerns, and note any changes that might affect your transition. This proactive dialogue creates a foundation of trust and helps ensure that both parties remain aligned throughout the rental term.

Building a Network of Support

Don’t underestimate the power of community. Engage with current homeowners, join local real estate forums, and participate in neighborhood groups. These networks often share valuable insights that can help you navigate the complexities of future home repairs, financing, and even legal questions along the way.

Putting It All Together: A Holistic Approach to Rent-to-Own

The rent-to-own path, when navigated with proper planning and due diligence, can be a rewarding journey toward achieving full homeownership. Here’s how to integrate everything discussed:

Strategic Planning

Start by aligning your long-term goals with your current financial situation. Recognize that while your monthly rent is higher than typical rental payments, it is an investment in your future. Use the rental period not only to build equity but also to hone budget management skills, improve your credit score, and learn about the local housing market dynamics.

Preparing for the Unexpected

Life can be unpredictable. Have an exit strategy ready should circumstances change—whether due to a job loss, health issues, or changes in your family dynamics. Preparing for alternative scenarios helps you maintain control over your situation, granting peace of mind even when faced with unexpected challenges.

Learning and Adaptation

Every step of this process is an opportunity to learn. Whether it’s acquiring handyman skills for maintenance or understanding the nuances of a legal contract, use your rent-to-own period as a time to educate yourself about the intricacies of homeownership. Over time, this knowledge will empower you as a well-informed buyer, ready for the transition.

Avoiding Common Pitfalls

Be proactive in circumventing frequent errors:

- Thoroughly Review Contracts: Never skim through agreements. Absorb every detail—understanding the fine print now saves you from potential legal and financial complications later.

- Realistically Estimate Expenses: Include regular maintenance, repair costs, and other hidden expenses when planning your budget.

- Build a Robust Savings Plan: Even if part of your payments counts toward the eventual purchase, keep supplemental savings to cover unforeseen costs.

Consistently reassessing your plan and being ready to adapt is key to a smooth transition.

Embracing the Long-Term Vision

Rent-to-own is not merely a temporary solution; it is an investment in a future where you become a confident, capable homeowner. With this strategy, the renting period serves as a preparatory stage—teaching you financial discipline, providing a safety net against market volatility, and offering a realistic preview of what homeownership entails. Every step taken during this period adds to your understanding and readiness for the responsibilities that lie ahead.

Additional Considerations for the Future

- Community Engagement: Getting involved in local events or homeowner associations can enrich your experience and provide a support network that is invaluable once you become a full-fledged homeowner.

- Regular Financial Reviews: As circumstances evolve, conduct periodic assessments of your budget, savings, and future home-related expenses to ensure that you’re still on track.

- Continued Professional Advice: Maintaining relationships with financial advisors, real estate professionals, and legal experts is always beneficial. Their guidance can help you stay informed about market trends, financing alternatives, and legal protections.

This Is a Continuous Learning Process

Embracing the rent-to-own model offers far more than just a contractual agreement—it provides a roadmap to personal and financial growth. This method not only propels you toward homeownership but also empowers you with the practical skills and savvy needed in today’s dynamic real estate market. By thoroughly understanding every aspect of the rent-to-own process, from contract details to budgeting and legal rights, you’re setting yourself up for a successful transition that is as much an investment in your future as it is in your property.

Every monthly payment in a rent-to-own agreement is more than just rent; it’s an investment in your future and a step toward achieving your homeownership dreams. These payments not only reflect your commitment to securing a home but also symbolize the financial discipline and planning that pave the way for a brighter future.

With this enhanced, comprehensive guide at your disposal, you are now fully equipped to approach rent-to-own agreements with confidence and clarity. Remember, every decision you make along this journey matters—ensuring that, when the time comes, you will walk into your new home prepared for both its rewards and its responsibilities. Enjoy the process, learn at every step, and soon you’ll transform the dream of homeownership into your everyday reality.

Further Steps and Insights

- Educational Workshops and Seminars: Look out for local or online events that target first-time homebuyers. These can be invaluable in clarifying the details of rent-to-own and traditional mortgage options.

- DIY Home Maintenance Workshops: Gaining practical repair skills not only saves money but also builds your confidence in managing your home.

- Market Analysis Tools: Invest time in learning how to monitor local real estate trends. This insight will prove beneficial when it’s time to evaluate your rent-to-own property’s future value.

As always, it is important to carefully evaluate any decision prior to taking action, however, do not permit analysis to become the poison preventing you from ever fully pursuing your goals. So, let’s make this the year of decision making.

Disclaimer: This article is for informational purposes only and should not be considered financial or investment advice. Investing in any of the mentioned passive income streams involves risk, and you could lose money. Before making any investment decisions, it is essential to conduct your own thorough research and consider consulting with a qualified financial advisor who can assess your individual financial situation, risk tolerance, and goals. The potential returns discussed are illustrative and not guaranteed. Market conditions, regulations, and other factors can significantly impact the performance of any investment or business venture.