Introduction to Sustainable Investing

Sustainable investing refers to an investment strategy that considers environmental, social, and governance (ESG) criteria alongside financial returns. This approach seeks to not only generate profit but also contribute positively to society and the planet. As global awareness of pressing issues such as climate change, inequality, and corporate governance grows, sustainable investing has gained traction among individual and institutional investors alike. Investors are increasingly recognizing that their investment choices can influence societal wellbeing and environmental health, prompting them to look beyond traditional financial performance metrics.

The significance of sustainable investing has escalated in today’s financial landscape, with research indicating a remarkable growth trajectory. According to the Global Sustainable Investment Alliance, global sustainable investment assets reached $35.3 trillion in 2020, representing a 15% increase from 2018. Such statistics reveal a palpable shift in investor mentality, illustrating that an increasing number of stakeholders prioritize investments that align with their values, alongside the potential for attractive financial returns.

Moreover, both retail and institutional investors are becoming more discerning regarding their portfolios. They are increasingly demanding transparency from companies regarding their ESG practices. This growing expectation is driving corporations to adopt sustainable practices, ultimately cultivating a more resilient and ethically responsible marketplace. Furthermore, research from the Morgan Stanley Institute for Sustainable Investing indicates that sustainable funds often perform comparably to or outperform their conventional counterparts, offering evidence that profitability and responsibility can coexist. Consequently, understanding the dynamics of sustainable investing is crucial for current and future investors aiming to navigate this evolving financial landscape effectively.

The Principles of Sustainable Investing

Sustainable investing is a methodology that integrates environmental, social, and governance (ESG) criteria into investment decisions, promoting a holistic approach to portfolio management. One of the core principles of sustainable investing is the recognition that companies demonstrating strong ESG performance often exhibit resilient financial returns. Investors evaluate these criteria rigorously, seeking firms that not only strive for financial profit but also contribute positively to society and the environment. This alignment with responsible business practices resonates with a growing mandate among investors to drive change through their financial choices.

Active ownership is another essential principle, where investors engage with companies to advocate for better sustainability practices. This could involve participation in shareholder meetings, discussions with management, and voting on ESG-related issues. By actively influencing the companies they invest in, investors can promote transparency, accountability, and ethical practices, creating a ripple effect that can elevate industry standards and practices. This engagement underscores the idea that financial success and socioeconomic prosperity are interconnected, ultimately leading to more sustainable business models.

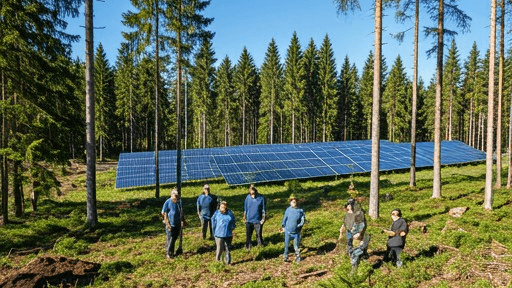

Impact investing forms a further cornerstone of sustainable investing, focusing on generating specific environmental and social impacts alongside competitive financial returns. Investors may consider sectors such as renewable energy, affordable housing, or healthcare, where their capital can contribute to tackling pressing global challenges. Implementing strategies like screening for ESG-compliant companies, community investing, or socially responsible funds enables investors to align their portfolios with their values and support businesses that are advancing sustainable development goals.

These principles guide sustainable investors in constructing portfolios that are not only financially beneficial but also play a vital role in fostering a better world, thereby effectively merging the pursuit of profit with the commitment to positive societal impact.

Identifying Sustainable Companies

Investing in sustainable companies requires a well-structured approach. A pivotal starting point is to familiarize oneself with Environmental, Social, and Governance (ESG) ratings, which serve as benchmarks for assessing a company’s sustainability practices. These ratings are derived from a range of criteria that evaluate a firm’s environmental impact, its social responsibility, and the robustness of its governance structures. Investors can access various platforms such as Bloomberg, MSCI, and Sustainalytics to find these critical assessments. Understanding these ratings can significantly enhance an investor’s ability to identify sustainable organizations.

In addition to ESG ratings, utilizing research tools and databases tailored to sustainable investing is essential. Platforms like Morningstar and Yahoo Finance provide valuable insights into corporate sustainability efforts by offering comprehensive data that includes company-specific sustainability reports, certifications like ISO 14001, and impacts on local communities. These resources equip investors with the necessary information to gauge a company’s commitment to sustainable practices, allowing for more informed decision-making.

The importance of transparency and accountability cannot be overstated when evaluating sustainable companies. Firms that prioritize sustainability often report their initiatives publicly and provide detailed disclosures regarding their environmental stewardship, labor practices, and governance policies. This level of openness fosters trust and allows investors to assess whether a company aligns with their values. Engaging with investor advocacy groups and participating in shareholder dialogues can also offer insights into a company’s sustainability narrative and encourage continuous improvement.

Incorporating these strategies enhances an investor’s ability to identify sustainable companies effectively. By leveraging ESG ratings, utilizing specialized research tools, and emphasizing corporate transparency, investors can make responsible choices that yield both financial returns and positive societal impact.

The Financial Benefits of Sustainable Investing

Investing with an ecologic perspective has gained prominence in recent years, and one of the prevailing misconceptions is that it entails sacrificing financial returns in favor of ethical considerations. However, numerous studies indicate that sustainable investments can yield superior returns over the long term, counteracting this myth. According to a report from Morgan Stanley, sustainable equity funds outperformed their traditional counterparts in the stock market, demonstrating that investing in responsible companies can be both lucrative and impactful.

One significant advantage of sustainable investing is the potential for long-term growth. Companies that prioritize environmental, social, and governance (ESG) factors often display stronger operational performance, less volatility, and better risk management. A study conducted by the University of Oxford found that companies with robust sustainability practices exhibit lower cost of capital and superior performance on stock price and financial metrics compared to their less sustainable peers. This indicates that an emphasis on sustainability not only aligns with ethical values but also results in enhanced financial health.

Investing ecologically can mitigate risks. As global awareness of climate change and social responsibility rises, companies that neglect these aspects may encounter reputational and regulatory risks. The Global Sustainable Investment Alliance report highlighted that sustainable companies tend to perform better during economic downturns. Therefore, investors who focus on businesses with robust sustainable practices may experience greater stability and fewer losses in an unpredictable market.

In conclusion, the financial benefits of sustainable investing are becoming increasingly clear. By investing in companies committed to sustainable practices, investors may not only generate solid returns but also contribute positively to society and the environment, supporting both individual financial goals and larger global initiatives.

Challenges and Criticisms of Sustainable Investing

Sustainable investing, which aims to generate financial returns while also contributing to social and environmental objectives, faces several challenges and criticisms that can complicate its implementation and effectiveness. One of the primary issues is the lack of standardization in Environmental, Social, and Governance (ESG) criteria. Different organizations and rating agencies often utilize disparate metrics to evaluate sustainability, leading to inconsistencies that can confuse investors. This discrepancy not only erodes trust in ESG ratings but also makes it challenging for investors to compare companies effectively, potentially undermining the entire sustainable investing framework.

Another significant concern within the realm of sustainable investing is the phenomenon known as greenwashing. This term refers to the practice of companies exaggerating or misrepresenting their commitment to sustainability to appeal to environmentally conscious investors. While some firms may genuinely strive for sustainable practices, others might engage in deceptive marketing tactics that can mask harmful practices. This misleading representation not only misguides investors but also contributes to skepticism around the effectiveness of sustainable investing as a whole.

Additionally, the challenge of obtaining reliable and complete data is a significant hurdle for sustainable investors. Accurately collecting information about a company’s environmental, social, and governance (ESG) performance is often challenging due to a lack of transparency or inaccessible data. The absence of standardized metrics and uniform reporting makes it tough to accurately evaluate a company’s commitment to sustainability.

Critics often raise the question of whether sustainable investing can indeed drive meaningful change in corporate practices. Some argue that the motivations behind capital allocation may still lean towards profit maximization, overshadowing genuine efforts to make a positive impact. Thus, while sustainable investing has the potential to encourage better corporate behaviors, its effectiveness in fostering systemic change remains a topic of ongoing debate.

Tools and Resources for Sustainable Investors

Sustainable investing has gained significant traction over the years, leading to the development of various tools and resources that cater to investors who wish to align their financial goals with their values. One of the primary resources available to these investors is the growing array of sustainable-focused investment funds and exchange-traded funds (ETFs). These funds typically invest in companies that demonstrate strong environmental, social, and governance (ESG) practices, thus allowing investors to indirectly support businesses that contribute positively to societal and environmental outcomes. Through platforms such as Morningstar or Sustainable Investing Platform, investors can evaluate the performance and sustainability ratings of various funds.

In addition to traditional funds, robo-advisors have become increasingly popular among sustainable investors. These automated platforms use algorithms to create and manage investment portfolios tailored to the investor’s risk tolerance and values. Many robo-advisors, such as Betterment and Wealthsimple, now offer options specifically designed for sustainable investing, making it easier for individuals to integrate ESG criteria into their investment decisions.

For those looking to expand their knowledge in sustainable investing, a plethora of educational resources is available. Online platforms like Coursera and edX offer courses focusing on sustainable finance and responsible investing, providing foundational knowledge and advanced strategies. Books such as “Investing for Change” by J. C. F. Strach and “The Responsible Investor” by John McMahon can serve as invaluable resources, offering insights into historical trends and future prospects in the sustainable investment landscape.

Ultimately, whether through investment funds, robo-advisors, or educational literature, sustainable investors now have access to a rich array of tools and resources designed to enhance their investing journey while making a meaningful impact on society.

Taking Action: How to Start Investing Sustainably

Embarking on the journey of sustainable investing requires a thoughtful approach that aligns personal values with investment choices. The first step is to create a personal investment strategy that reflects these values, ensuring that it encompasses environmental, social, and governance (ESG) considerations. Investors should begin by assessing their priorities and determining the aspects of sustainability that matter most to them. This could involve focusing on renewable energy, social justice, or corporate governance reforms, among other areas.

Setting clear and measurable goals for impact is crucial in this process. Define specific financial targets and desired social or environmental outcomes to track the effectiveness of your investments. By establishing these goals, investors can make informed decisions that not only seek to generate returns but also contribute to broader societal benefits. It is essential to strike a balance between achieving financial returns and making a difference in the community.

In exploring various sustainable investment options, individuals can consider multiple avenues, including socially responsible funds, green bonds, and direct investments in companies with sustainable practices. Diversifying the investment portfolio is essential to mitigate risks while pursuing sustainable options. Engaging with financial advisors who specialize in sustainable investing can provide valuable insights and highlight opportunities that may not be evident otherwise.

Continuous education plays a vital role in successful sustainable investing. Staying informed about the latest trends, news, and regulations surrounding sustainable investments will enhance decision-making and ensure that investors remain aligned with their personal values. Resources such as webinars, workshops, and publications focusing on ESG criteria can support ongoing learning and foster a deeper understanding of the sustainable investment landscape. By taking these proactive steps, investors can make meaningful contributions to sustainable development while achieving their financial objectives.