Investing for Beginners – Part Two: Mastering the Tools & Refining Your Strategy

Welcome back! In Part One of our investing journey, we laid down the “cheat sheet” – the essential Do’s and Don’ts designed to give you a running start in the world of investing, all without needing that four-year finance degree. We talked about defining your “why,” understanding risk, the power of starting small, and the importance of continuous learning. We also covered crucial pitfalls to avoid, like trying to time the market and letting emotions dictate your decisions.

If you haven’t read Part One, I highly recommend giving it a look before diving in here. It truly sets the stage.

Now that you’re armed with that foundational mindset, you might be thinking, “Okay, I get the basics… but what exactly should I be looking at? How do these pieces fit together to build something real?” Those are precisely the questions we’re tackling in Part Two.

Think of Part One as learning the rules of the road and getting your learner’s permit. Part Two is about getting more familiar with the vehicle itself, understanding different types of roads, and planning your route. We’re going to delve deeper into some specific investment tools, explore how your personal risk tolerance actually shapes your portfolio, guide you through choosing your “investment launchpad” (your brokerage account), and revisit the magic of compounding with a more powerful lens.

Ready to take the next step? Let’s roll!

1. ETFs Unpacked: Your Versatile Investment Power Tool

In Part One, I briefly introduced Exchange-Traded Funds (ETFs) as a fantastic option for beginners. Now, let’s pop the bonnet and really understand why they’re such a valuable part of an investor’s toolkit, especially when you’re starting out.

- What Exactly IS an ETF (A Deeper Look)? An ETF is a basket of investments – like stocks, bonds, or commodities – that tracks a specific index, sector, commodity, or other asset. Think of an S&P 500 ETF: instead of you having to buy shares in all 500 of the largest U.S. companies individually (which would be incredibly expensive and time-consuming!), you can buy a single share of an S&P 500 ETF. This one share gives you a tiny piece of ownership in all those companies, reflecting their collective performance. The beauty is that ETFs trade on stock exchanges throughout the day, just like individual stocks, meaning their prices can fluctuate.

- Why ETFs Shine for Beginners (and Seasoned Investors Alike):

- Instant Diversification: This is a huge one. As we discussed, not putting all your eggs in one basket is crucial. ETFs often provide built-in diversification. That S&P 500 ETF? You’re diversified across 500 companies and multiple sectors of the U.S. economy with one purchase.

- Low Cost: Many ETFs, especially broad-market index-tracking ETFs, have very low “expense ratios.” The expense ratio is an annual fee, expressed as a percentage of your investment, that covers the fund’s operating costs. Lower fees mean more of your money stays invested and working for you. This is a critical advantage over many traditional mutual funds, which can have higher expense ratios that eat into your returns over time.

- Transparency: Most ETFs are required to disclose their holdings daily. This means you can see exactly what assets the ETF owns, giving you a clear picture of what you’re investing in.

- Tradability & Accessibility: You can buy and sell ETFs through any standard brokerage account during market hours, just like stocks. Many brokers now offer commission-free trading for ETFs, and with the advent of fractional shares, you can often invest in expensive ETFs with just a few dollars.

- Variety: There’s an ETF for almost everything imaginable. While this variety can be overwhelming (and we’ll touch on keeping it simple), it also means ETFs can serve many different roles in a portfolio as you become more experienced.

- A Glimpse into Different ETF Flavors (Keep it Simple to Start!): While the world of ETFs is vast, beginners should typically focus on broad-market index ETFs. However, it’s good to know a few categories exist:

- Stock ETFs (Equity ETFs): These track stock market indexes (like the S&P 500, NASDAQ 100, or a total stock market index). They can be U.S.-focused or international.

- Bond ETFs (Fixed Income ETFs): These invest in various types of bonds (government, corporate, municipal). They generally offer lower risk and lower potential return than stock ETFs and can help stabilize a portfolio.

- Sector ETFs: These focus on specific industries, like technology, healthcare, or energy. These are generally for more targeted bets and often less suitable for a beginner’s core portfolio.

- Commodity ETFs: These track the price of commodities like gold or oil.

- Real Estate ETFs (REIT ETFs): These invest in Real Estate Investment Trusts, offering exposure to the real estate market.

- How to Look at a Simple ETF (Without Getting Lost in jargon): When you’re looking at an ETF on your broker’s platform or a financial website, here are a few key things to glance at:

- What Index it Tracks: Does it track the S&P 500? A total stock market index? This tells you what you’re actually investing in.

- Expense Ratio: As mentioned, lower is generally better. For broad index ETFs, you’ll often see ratios well below 0.10% (meaning $10 per $10,000 invested, annually).

- Assets Under Management (AUM): This is the total value of all the money invested in the ETF. A larger AUM often (but not always) indicates a well-established and liquid fund.

- Holdings: Take a peek at the top 10 holdings to get a feel for the major companies within the ETF.

- Actionable Insight: Go to a reputable financial news site (like Yahoo Finance, MarketWatch) or your chosen brokerage’s research section. Look up a well-known S&P 500 ETF (common tickers include VOO, IVV, SPY) or a total stock market ETF (like VTI, ITOT). Just explore the information presented. Get comfortable seeing these terms. Don’t feel pressured to understand everything immediately; it’s about familiarity.

2. Risk Tolerance Revisited: From Feeling to Portfolio (Hello, Asset Allocation!)

In Part One, we talked about understanding your personal risk tolerance – your stomach for potential ups and downs in your investments. Now, let’s connect that feeling to a concrete strategy: Asset Allocation.

Asset allocation is simply how you divide your investment portfolio among different asset categories, primarily stocks, bonds, and cash (or cash equivalents like money market funds). It’s often cited as one of the most critical decisions an investor makes, even more so than picking individual investments, because it’s the primary driver of your portfolio’s overall risk and return profile.

- Bridging Risk Tolerance and Asset Allocation: Your willingness and ability to take risks directly inform your asset allocation.

- Higher Risk Tolerance: If you’re younger, have a long time horizon, and are comfortable with more volatility for potentially higher returns, you’ll likely allocate a larger percentage of your portfolio to stocks.

- Lower Risk Tolerance: If you’re closer to retirement, need the money sooner, or simply can’t sleep at night with large portfolio swings, you’ll likely allocate more to bonds and cash, which are generally less volatile.

- Simple Asset Allocation Examples (Not Prescriptive Advice!): These are just illustrative. Your ideal allocation depends on your unique circumstances.

- Aggressive (e.g., young investor, long time horizon): 80-90% Stocks, 10-20% Bonds.

- Moderate (e.g., mid-career, balancing growth and stability): 60-70% Stocks, 30-40% Bonds.

- Conservative (e.g., nearing or in retirement, capital preservation focus): 30-50% Stocks, 50-70% Bonds.

- The Role of Different Assets:

- Stocks: The growth engine. Historically offer higher returns but come with greater volatility.

- Bonds: The stabilizer. Generally provide lower returns than stocks but are less volatile and can cushion the portfolio during stock market downturns. They can also provide income.

- Cash: For liquidity and an emergency buffer. Not really a long-term investment for growth due to inflation.

- Actionable Insight: Think about a significant market drop, say 20% (which happens from time to time). If you had $10,000 invested, how would you feel if it temporarily became $8,000?

- If 90% was in stocks ($9,000), a 20% stock market drop could mean your stocks are now worth $7,200. Your total portfolio ($7,200 stocks + $1,000 bonds) would be $8,200 (an 18% drop).

- If 60% was in stocks ($6,000), a 20% stock market drop could mean your stocks are now worth $4,800. Your total portfolio ($4,800 stocks + $4,000 bonds) would be $8,800 (a 12% drop). This kind of mental exercise can help make the abstract concept of risk tolerance more tangible.

3. Choosing Your Investment Launchpad: Selecting a Brokerage Account

Okay, you’re fired up about ETFs, you’re thinking about your asset allocation… but where do you actually do all this investing? You need a brokerage account. This is an account that allows you to buy and sell investments like stocks, bonds, and ETFs.

Choosing a brokerage can feel daunting because there are many options. But by focusing on a few key factors, you can find one that’s right for you.

- Key Factors to Consider When Choosing a Broker:

- Fees, Fees, Fees: This is a big one we talked about in Part One.

- Trading Commissions: Many brokers now offer $0 commission trades for stocks and ETFs, which is fantastic for beginners. Check this first!

- Account Minimums: Some brokers require a minimum amount to open an account. Many have no minimums.

- Other Fees: Look out for account maintenance fees (if you don’t meet certain criteria), transfer fees, or fees for research/data. Generally, you want to minimize these.

- Investment Options:

- Ensure the broker offers a wide range of low-cost ETFs.

- Fractional Shares: Can you buy a piece of a share? This is great if you’re investing small amounts and want to buy into ETFs or stocks with high share prices.

- Ease of Use & Platform:

- Is the website and/or mobile app intuitive and easy to navigate? You don’t want a platform that makes you feel confused. Many offer demo accounts to try before you commit.

- Research Tools & Educational Resources:

- What kind of research reports, screening tools, and educational articles/videos does the broker provide? These can be very helpful as you learn.

- Customer Support:

- How can you reach them if you have a problem (phone, chat, email)? What are their support hours? Good support can be invaluable.

- Account Types Offered:

- Do they offer the types of accounts you need? Most beginners will start with a taxable brokerage account or an IRA (like a Roth or Traditional IRA, which we covered in Part One’s “Do’s”).

- Security: Ensure the broker is a member of SIPC (Securities Investor Protection Corporation), which protects your investments up to $500,000 (including $250,000 for cash) if the brokerage firm fails. Also look for standard security features like two-factor authentication.

- Fees, Fees, Fees: This is a big one we talked about in Part One.

- Some Names You Might Hear (Do Your Own Research!): You’ll likely come across names like Vanguard, Fidelity, Charles Schwab (often considered giants for long-term investors with great low-cost options and research), and newer platforms like Robinhood, Webull, or M1 Finance (which often appeal with slick mobile apps and fractional shares, but always check their full fee structure and features). This is not an endorsement of any specific broker. The best one for you depends on your individual needs and preferences.

- Actionable Insight: Before you start looking, make a short checklist of your top 3-5 priorities. Is it $0 commissions above all else? A super user-friendly mobile app? Access to specific research? Then, visit the websites of 2-3 brokers that seem to fit the bill and compare them against your checklist. Many financial news sites also publish annual brokerage reviews.

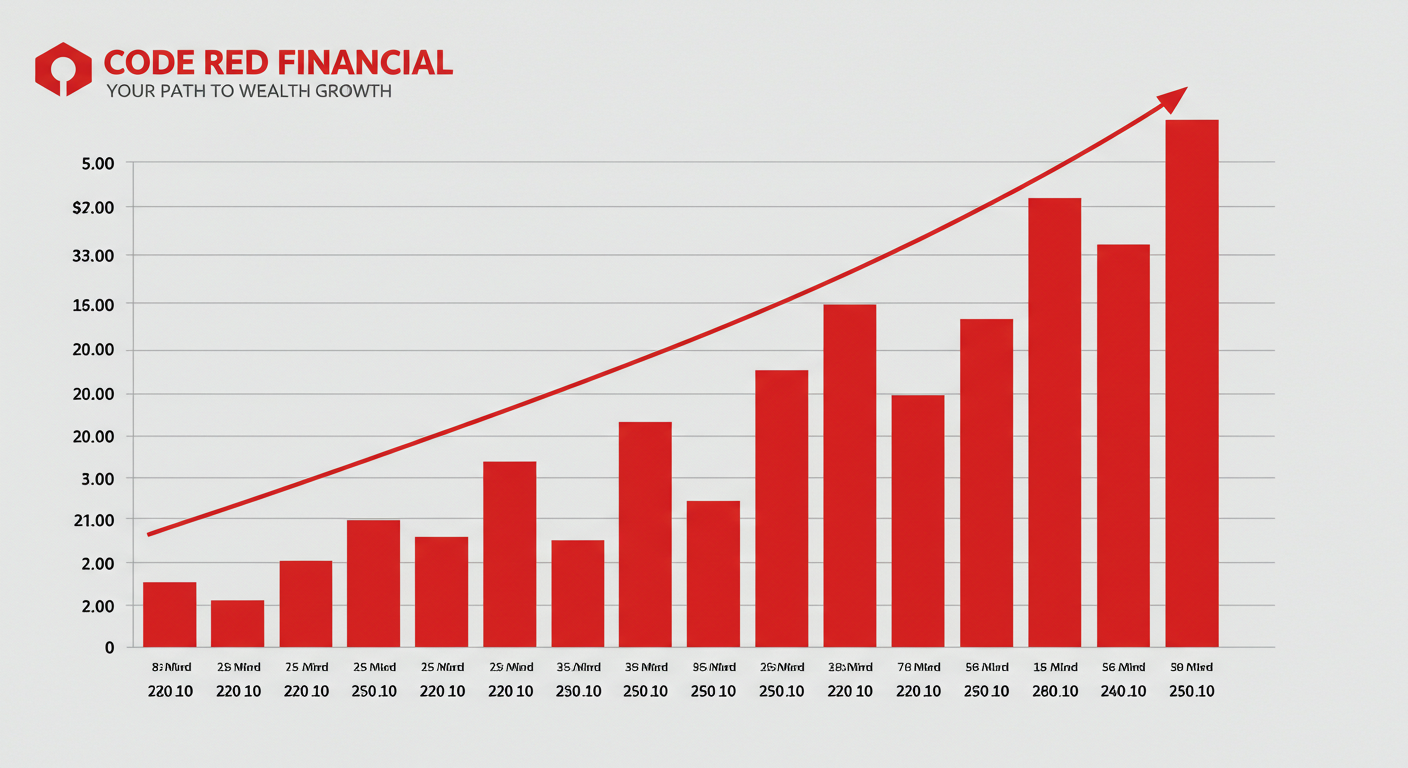

4. The Undisputed Champion: Compound Interest Revisited (Why Patience is Your Superpower)

We touched on compound interest in Part One, hailing it as the “eighth wonder of the world.” It bears repeating and a closer look because truly internalizing its power is fundamental to long-term investing success. It’s the engine that can turn modest, consistent savings into significant wealth over time.

Compounding is, simply put, your money earning money, and then that money earning more money. It’s a snowball effect.

- Let’s Get a Bit More Concrete (Hypothetical Example): Imagine Sarah starts investing $300 per month at age 25. Let’s assume she earns an average annual return of 7% (this is a hypothetical average; actual returns vary).

- After 10 years (age 35):

- She would have invested: $300/month * 12 months/year * 10 years = $36,000

- Her investment could be worth approximately: $52,000

- The “magic” (compound growth): $16,000

- After 20 years (age 45):

- She would have invested: $300/month * 12 months/year * 20 years = $72,000

- Her investment could be worth approximately: $155,000

- The “magic”: $83,000

- After 30 years (age 55):

- She would have invested: $300/month * 12 months/year * 30 years = $108,000

- Her investment could be worth approximately: $363,000

- The “magic”: $255,000

- After 40 years (age 65):

- She would have invested: $300/month * 12 months/year * 40 years = $144,000

- Her investment could be worth approximately: $790,000

- The “magic”: $646,000

- After 10 years (age 35):

- The Key Ingredients: Time and Consistency The two most powerful allies of compound interest are time (the longer your money is invested, the more time it has to compound) and consistency (regular contributions, even if small, keep feeding the snowball). This is why we emphasized starting NOW in Part One, even with small amounts.

- Actionable Insight: Don’t just take my word for it. Search online for a “compound interest calculator.” Many reputable financial sites offer them. Plug in some numbers: a starting amount, a monthly contribution, an estimated interest rate, and the number of years. Play around with the variables. See for yourself how changing the time horizon or the monthly contribution impacts the outcome. This can be a very motivating exercise!

Your Journey Continues: Building Confidence and Competence

Phew, Part Two is in the books! We’ve taken a deeper dive into ETFs, explored how your risk tolerance helps shape your asset allocation, navigated the considerations for choosing a brokerage, and really hammered home the incredible power of compound interest.

My hope is that you’re feeling even more equipped and less intimidated. Each piece of knowledge, each small action you take, builds upon the last. This isn’t about becoming an overnight expert; it’s about becoming a more confident and competent steward of your own financial future.

Remember, learning is a continual process. The financial world is vast, but you don’t need to know everything to succeed. Master these fundamentals, stay curious, and keep putting one foot in front of the other.

Here at Code Red Financial, we’re committed to being your partner on this journey. What topics would you like us to explore next? Perhaps a deeper look into specific retirement accounts? Or strategies for rebalancing your portfolio? Let us know!

For now, take these insights, revisit Part One if needed, and start thinking about those actionable steps. You’re building a skill set and a future, one smart decision at a time. You’ve absolutely got this!

Disclaimer: This article is for informational purposes only and should not be considered financial or investment advice. Investing in any of the mentioned passive income streams involves risk, and you could lose money. Before making any investment decisions, it is essential to conduct your own thorough research and consider consulting with a qualified financial advisor who can assess your individual financial situation, risk tolerance, and goals. The potential returns discussed are illustrative and not guaranteed. Market conditions, regulations, and other factors can significantly impact the performance of any investment or business venture.